Vietnam’s high-tech investment landscape has witnessed a remarkable transformation over the past decade, with the rise of a dynamic and integrated startup ecosystem.

Growth of High-Tech Startups

Vietnam’s startup ecosystem has evolved through 03 significant phases: activation (2013–2016), globalization (2017–2020), and attraction (2021–present). The government has played a pivotal role in this growth, initiating programs like Project 844, and various legal frameworks supporting the development of intellectual property-driven enterprises.

High-tech startups have expanded across major urban centers such as Hanoi, Ho Chi Minh City, and Da Nang. These enterprises focus primarily on cutting-edge fields including financial technology (fintech), educational technology (edtech), healthcare, artificial intelligence (AI), big data analytics, agricultural technology, and software-as-a-service (SaaS).

Sectoral investment highlights

Among the most notable sectors attracting investment, Fintech remains the leader in attracting venture capital, exemplified by Momo’s $100 million USD investment in 2019. E-wallets, online lending platforms, and blockchain solutions dominate this field. Regarding Healthcare technology, it saw unprecedented growth in 2023, becoming the top-funded sector with $160 million USD invested in the first nine months alone. Edtech and e-commerce continue to see steady investment, fueled by Vietnam’s young, tech-savvy population.

Other rising stars include startups in green technology, such as Vulcan Augmetics (3D-printed prosthetics limbs) and Green Desert (waste-to-energy systems), which demonstrate the social impact of high-tech entrepreneurship.

Venture Capital Landscape

Despite global downturns and investment caution, Vietnam recorded $527 million USD in total venture capital deals in 2023. While small-scale investments declined significantly, medium-scale deals (from $10 to $50 million USD) remained stable – signaling a maturing ecosystem with “soonicorn” potential.

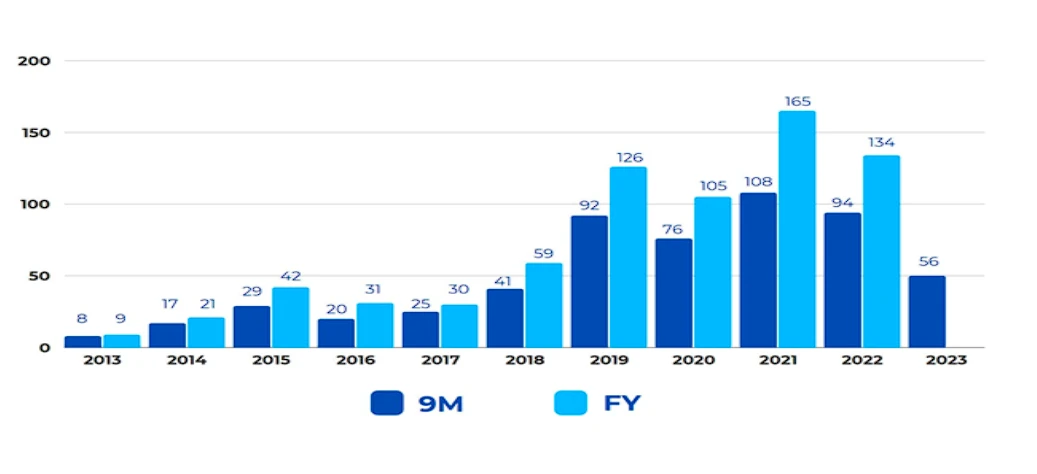

Chart showing the number of venture capital deals in Vietnam. Source: Do Ventures & NIC

By 2023, 208 investment funds operate in Vietnam, alongside 84 incubators and 35 accelerators. Both public and private institutions are involved, with increasing interest from international investors, particularly from Singapore and Korea.

Chart showing the number of venture capital deals in Vietnam.

Source: Do Ventures & NIC

Strategic government support

Public investment and co-investment models are being explored to stimulate early-stage funding, with plans to pilot public procurement programs for innovative products and services. Universities have also emerged as key innovation hubs, integrating startup training and incubators into their curricula.

Remained challenges

While Vietnam’s ecosystem is growing steadily, challenges persist: the legal environment needs further refinement, high-tech human resources require development, and the emergence of new unicorns has come to a halt since 2021. Nevertheless, the country’s proactive international integration through trade agreements, talent exchange, and startup diplomacy ensures a promising trajectory.

As Vietnam continues to harness the power of technology and innovation, its high-tech sectors are poised not only for regional leadership but also for meaningful global engagement.

Request Full Report & Join the Network

Interested in the full Vietnam Startup Ecosystem Report 2024? Join our network by making a request:

- Receive the full report for comprehensive insights.

- Get listed in the 2025 report and showcase your impact.

- Collaborate in building the next report with expert contributions.

- Sponsor the report development and gain exclusive exposure.

Stay updated on Vietnam’s innovation landscape by following us on NSSC’s official website.