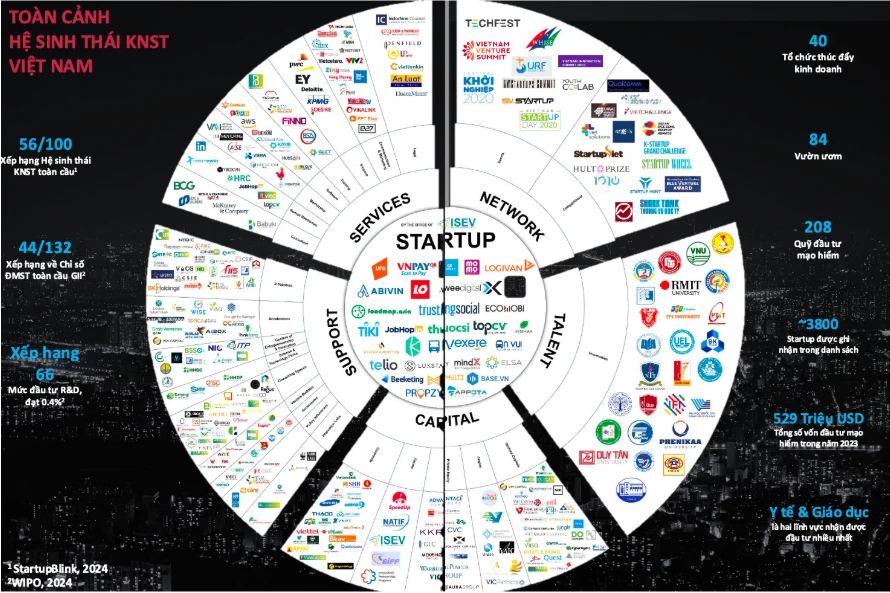

Vietnam’s startup ecosystem has rapidly evolved, with thousands of new enterprises emerging across various industries. Over the past decade, Vietnam has become one of Southeast Asia’s most dynamic startup hubs, with approximately 3,800 active startups. Among them, 02 have achieved unicorn status, surpassing a valuation of $1 billion, including MoMo and SkyMavis. In addition, 11 other startups are valued at over $100 million, reflecting strong growth momentum. The ecosystem is supported by more than 200 venture capital funds, 84 incubators, 35 accelerators, and over 20 national and local startup support centers.

Despite this progress, most startups are still in the early stages, with valuations remaining modest compared to those in more developed startup ecosystems such as Singapore and Indonesia.

Vietnam’s startup landscape is shaped by diverse industries, with fintech leading in both the number of startups and investment volume. Companies like MoMo and VNPay have transformed digital payments, making fintech one of the country’s most promising sectors. E-commerce is another high-growth industry, driven by platforms such as Tiki and Sendo, which have capitalized on the nation’s growing internet penetration and increasing consumer demand. In recent years, edtech startups like ELSA Speak and Topica have gained traction, particularly as online learning surged during the pandemic. Similarly, healthtech is emerging as a key sector, with companies like Med247 and BuyMed attracting significant investment. Blockchain and Web3 innovations, exemplified by Axie Infinity and Kyber Network, are putting Vietnam on the global map for cutting-edge technology. Meanwhile, green technology and agritech startups are beginning to shape the sustainability movement, addressing pressing environmental and agricultural challenges.

The workforce behind Vietnam’s startups is young, dynamic, and increasingly well-educated. The average startup employs around 80 people, a fourfold increase since 2020, indicating rapid expansion. Most founders have university degrees or higher, and many possess prior experience in the industries they seek to innovate. The country is also attracting an increasing number of international entrepreneurs, drawn by its competitive labor market, favorable business environment, and rapidly growing digital economy. However, talent shortages remain a significant challenge, particularly in deep-tech areas such as artificial intelligence, big data, and biotechnology.

Vietnamese startups typically adopt diverse business models to navigate the market. Many focus on business-to-consumer (B2C) models, particularly in fintech, e-commerce, and edtech, where large customer bases drive revenue growth. Others adopt business-to-business (B2B) approaches, particularly in software-as-a-service (SaaS), logistics, and healthcare technology. Platform-based businesses are also common, with companies like Grab and Be creating digital marketplaces that connect service providers and consumers. Subscription-based models are gaining popularity, especially in education and SaaS sectors, offering predictable revenue streams and long-term customer engagement. While most Vietnamese startups initially target the local market, expanding regionally or globally remains a challenge due to regulatory differences and competition from more established international players.

Despite its rapid progress, Vietnam’s startup ecosystem faces several challenges. Limited access to capital remains a concern, especially for early-stage startups that struggle to secure funding. Regulatory barriers, particularly in fintech and blockchain, create uncertainties that can hinder growth. Additionally, the shortage of experienced professionals in high-tech industries makes it difficult for startups to build competitive teams.

However, opportunities continue to grow, with strong government support through initiatives such as Project 844, the National Startup Support Center (NSSC), and the National Innovation Center (NIC). International investment is also on the rise, with venture capital firms from Singapore, Korea, and the United States increasingly eyeing Vietnam’s potential. Furthermore, the country’s ongoing digital transformation and rising consumer demand present significant growth opportunities for startups looking to scale.

Vietnam’s startup ecosystem is at a pivotal stage, balancing rapid expansion with the need for stronger support structures and regulatory clarity. As the country continues to attract investment and nurture innovation, its startups are well-positioned to play a vital role in shaping the future of the digital economy. The coming years will be crucial in determining how Vietnam’s startup enterprises evolve, but one thing remains clear: the entrepreneurial spirit in Vietnam is stronger than ever, and the journey ahead is full of promise.

Request Full Report & Join the Network

Interested in the full Vietnam Startup Ecosystem Report 2024? Join our network by making a request:

- Receive the full report for comprehensive insights.

- Get listed in the 2025 report and showcase your impact.

- Collaborate in building the next report with expert contributions.

- Sponsor the report development and gain exclusive exposure.

Stay updated on Vietnam’s innovation landscape by following us on NSSC’s official website.